arizona maricopa county tax lien

Enter the property owner to search for. The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County.

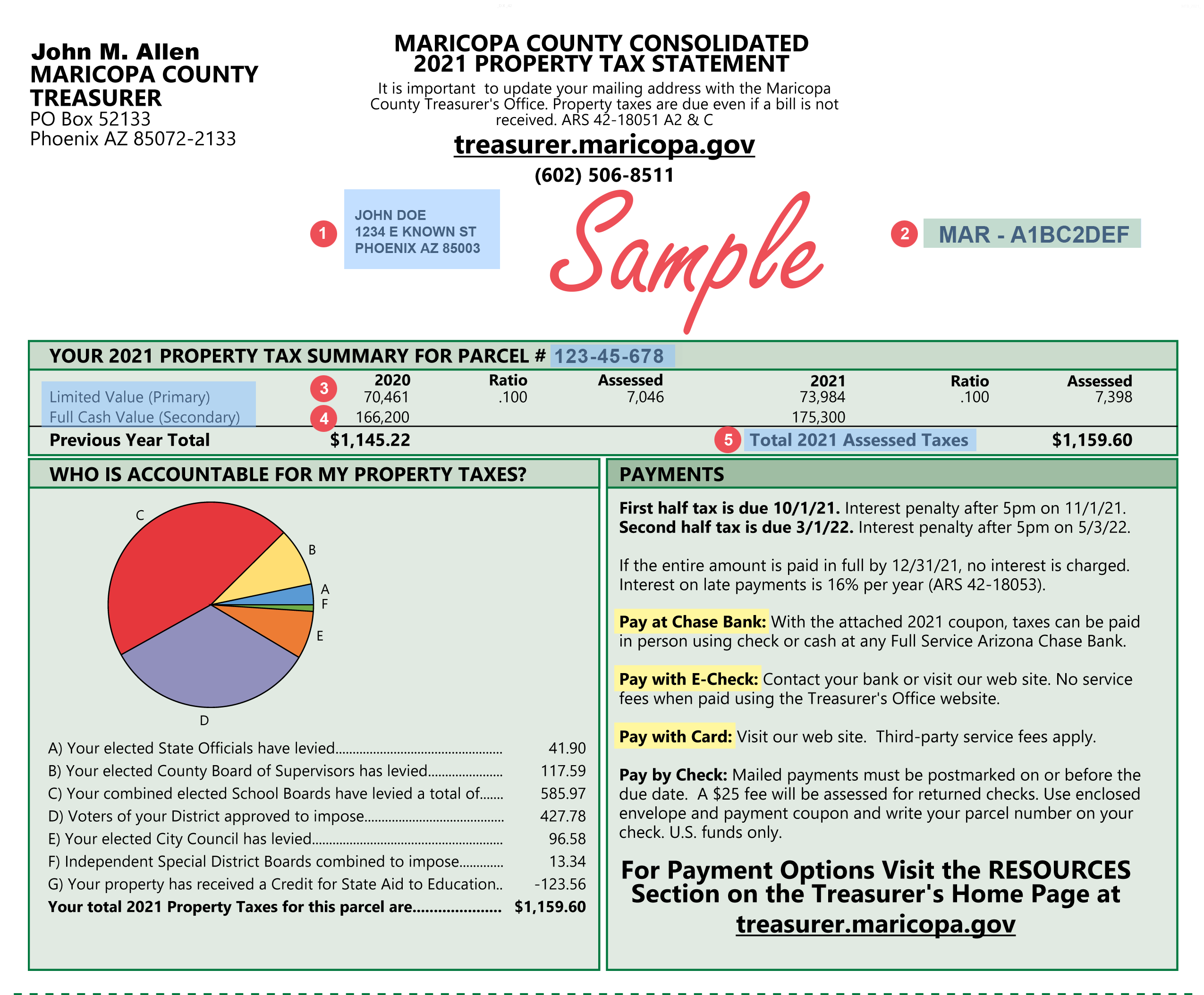

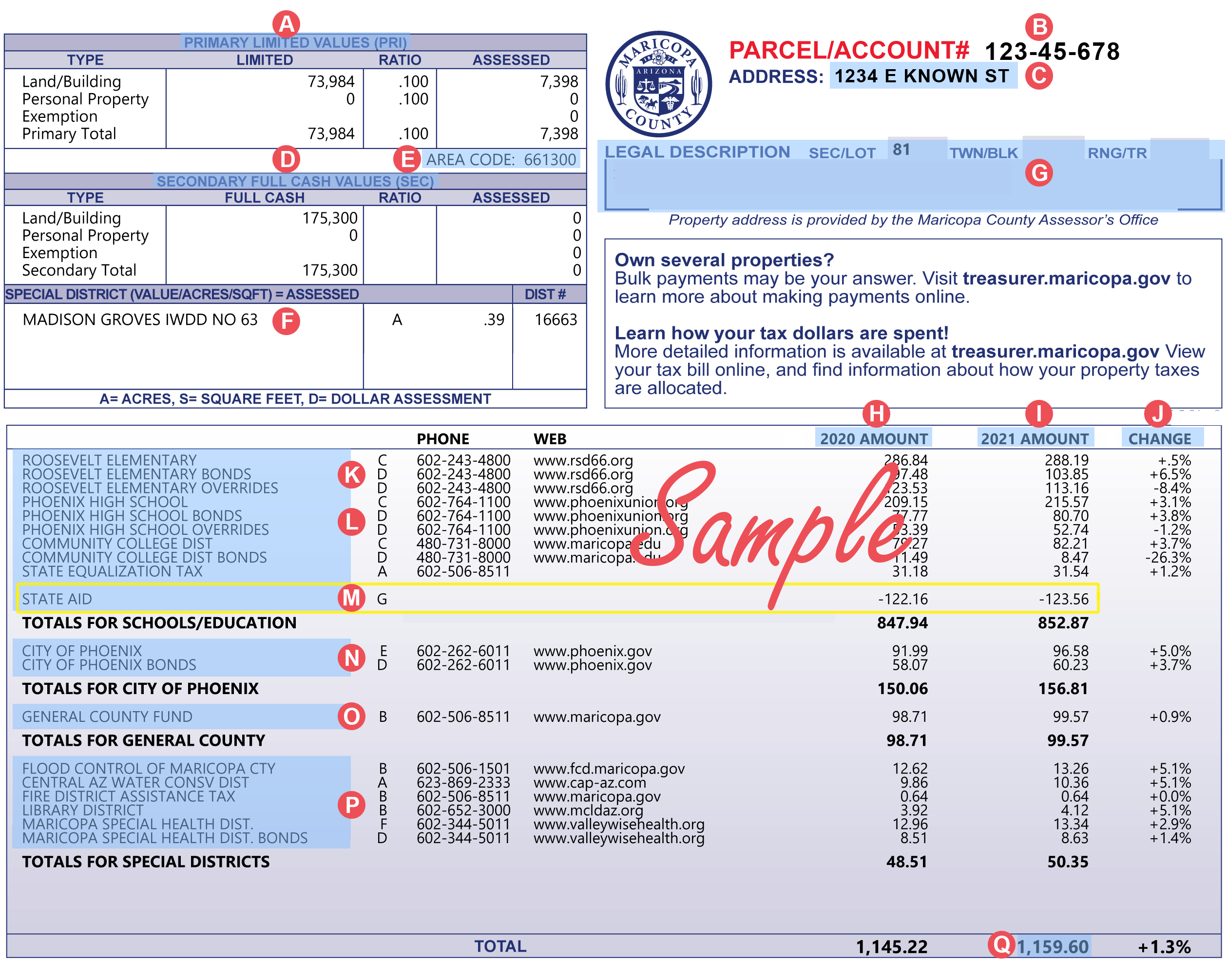

Interest on delinquent property tax is set by Arizona law at 16 percent simple and accrues on the first day of each month including weekends and holidays and cannot be waived.

. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax. 9 Arizona counties have now released their 2022 Tax Lien auction properties. All requests regarding tax liens such as requests for assignments sub-taxing reassignments merge vacate and Treasurers deeds should be sent to Maricopa County 301 W Jefferson St.

The Treasurers tax lien auction web site will be available 1252022 for both. The Tax Lien Sale will be held on February 9 2021. The sale of Maricopa County tax lien certificates at the Maricopa.

Jefferson Street Suite 140 Phoenix AZ 85003-2199 Please use the format below when submitting a purchase request. Tax deeded land sales are conducted by the Maricopa County Treasurers Office on an as-needed basis with Maricopa County acting as the agent for the State of Arizona. Ad Register and Subscribe now to work with legal documents online.

PdfFiller allows users to edit sign fill and share all type of documents online. Ad Find Anyones Maricopa Lien Records. Maricopa County Arizona tax lien certificates are sold at the Maricopa County tax sale annually in the month of February.

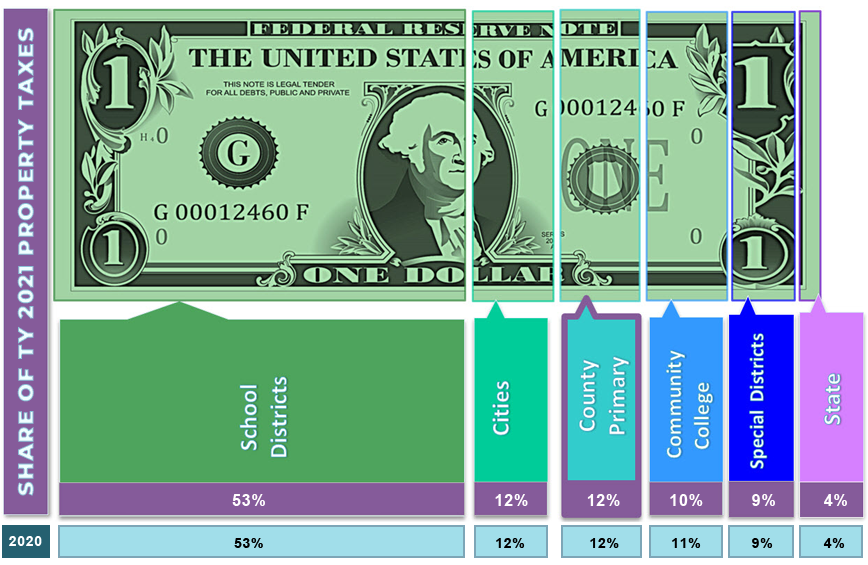

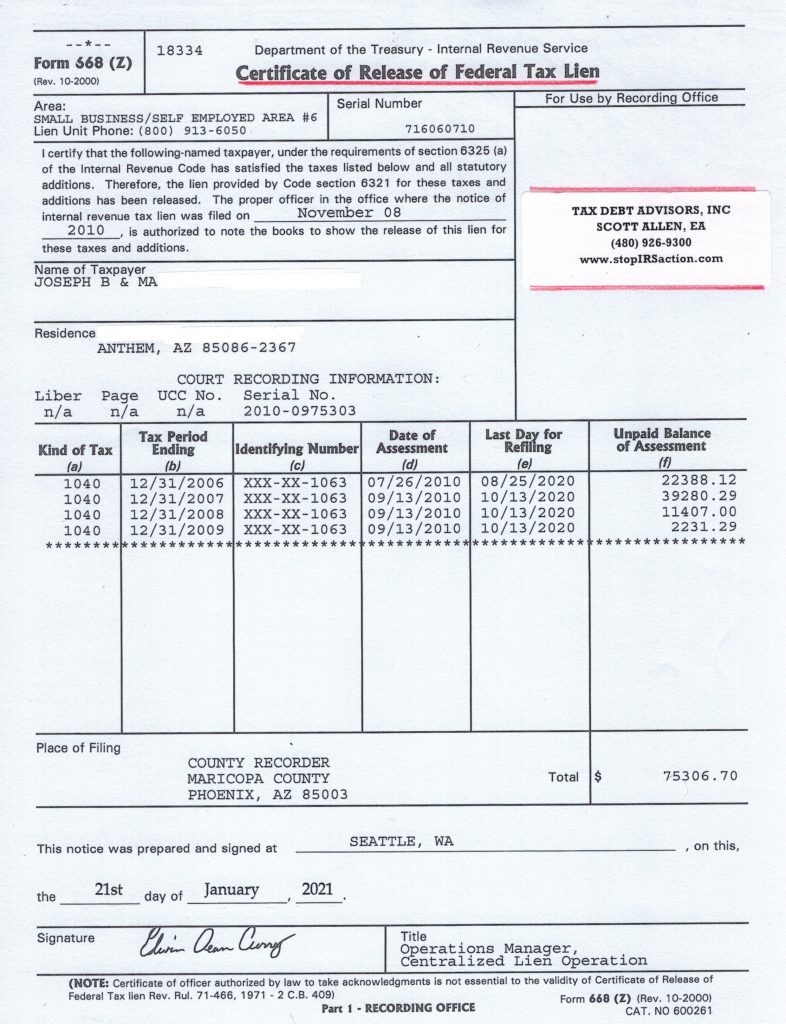

Signing up for an eNotice is easy to use convenient provides archives. Maricopa County Treasurer Attention. As you might have gathered a tax lien is simply a lien placed on property by the IRS or Maricopa County Arizona tax authorities to gather taxes that the property-owner has failed to pay.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. The Maricopa County Treasurer. You can now map search browse tax liens in the Apache Cochise Coconino Maricopa Mohave.

The Tax Lien Sale of unpaid 2020 real property taxes will be held on and closed on Tuesday February 8 2022. The Maricopa County Assessors Office offers electronic notices or eNotices for Notices of Valuation. Enter the address or street intersection to search for and then click on Go.

Ad Find The Best Deals In Your Area Free Course Shows How. Do not include city or apartmentsuite numbers. Tax Lien Department 301 W.

27 rows Form 140ET is used by individuals not required to file an Arizona individual income tax return but qualify to claim the refundable excise tax credit. Maricopa County AZ currently has 22642 tax liens available as of February 14. Arizona Department of Revenue 400 W Congress Street Tucson AZ 85701 Online Payment Once a payment has posted online a letter of Notice of Intent to Release State Tax Lien will be.

Maricopa County AZ currently has 13 tax liens available as of March 9.

Phoenix Arizona From The Sky Places To Go Arizona Favorite Places

Nice Chandler Metro Map Metro Map Zip Code Map Map

Maricopa County Arizona Federal Loan Information Fhlc

Maricopa County Approves 3 4 Billion Budget With Reduced Property Tax Rate Ktar Com

Pin On Maricopa Az Real Estate

Pin On Famous Arizona Architect Homes For Sale

Hillside Park Waterfall Sun City Az Sun City Az Sun City Hillside Park

Fountain Hills Once The World S Tallest Fountain Soothing Walls Blog Fountain Hills Breathtaking Places Best Places To Live

History Historic Roosevelt Neighborhood In Phoenix Arizona History Downtown Phoenix Phoenix Real Estate

Displaced In America Housing Loss In Maricopa County Arizona

City Limits Maricopa County Az

Pin On Wholesale Deals In Arizona

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors